Social Security Work Incentives & Planning

Who We Are & How We Can Help?

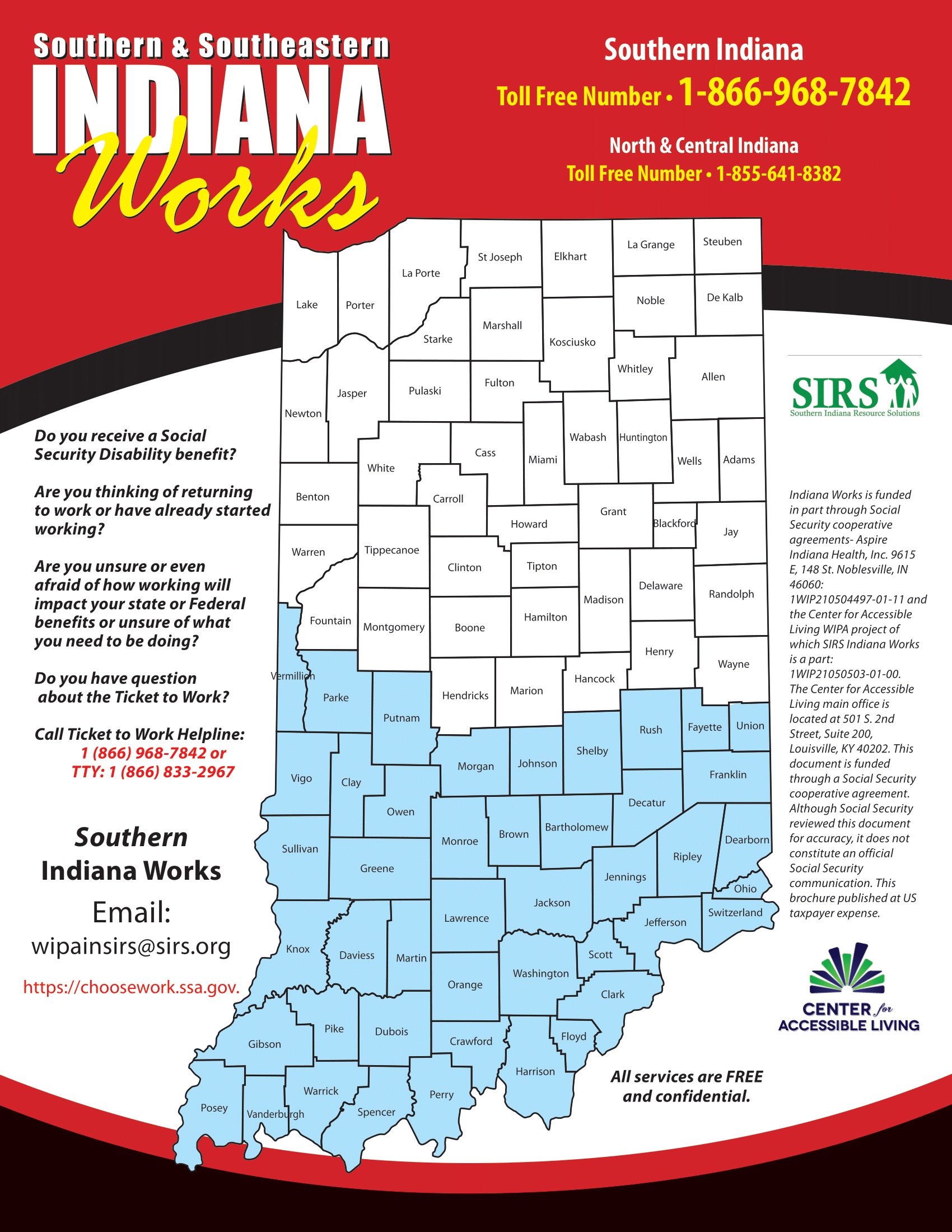

Work Incentives Planning and Assistance (WIPA) services are commonly known as "benefits counseling" for individuals who are receiving Social Security Disability Insurance (SSDI) and Supplement Security Income (SSI) who are currently employed, re-entering the work force or are interested in work.

The Indiana Works Community Work Incentive Coordinators (also called CWICs) have been trained to assist persons with disabilities who receive Social Security benefits, to determine the effect that employment earnings will have on their benefits and identifying possible resources in their pursuit of employment goals.

WHO do we assist?

Individuals who fit the following criteria:

- are between the ages of 14 and full retirement age*

- receive SSI or SSDI (or other Title 2 cash benefit)

- are working, interested in returning to work, are about to start work, OR are self-employed

*Youth between 14 and 25 do not have to fulfill the working criteria to be eligible for advisement.

We can help you to understand how work affects a variety of benefits:

- Medicaid

- Medicare

- Social Security Disability Insurance

- Supplemental Security Income

- Food assistance

- Housing subsidies

- Other State & Federal benefits

Ways to Make a Referral:

- Complete the general referral form and fax to 502-669-8928 OR email to our intake specialist wipa@calky.org. (Be sure to encrypt or password protect any email containing personal identifying information. If not able to encrypt or password protect, please fax to above number.)

OR:

- Call Ticket to Work Helpline at 866-968-7842.

OR:

- Email wipainsirs@sirs.org for more information.

Kim Steen

Community Work Incentive Coordinator

Cell: 812-470-1647

Email: kim.steen@sirs.org

Fax: 812-954-0724

Stacey Sims

Community Work Incentive Coordinator

Cell: 812-470-7889

Email: stacey.sims@sirs.org

Fax: 812-954-0724

2026 FACT Sheets

| - | -------------- | ----------------- | |

|---|---|---|---|

| Expedited Reinstatement | Download | Blind Work Expense | Download |

| Extended Medicare | Download | Impairment-Related Work Expenses for SSI | Download |

| Extended Period of Eligibility | Download | SSI Self-Employment | Download |

| Impairment-Related Work Expenses for SSDI | Download | Student-Earned Income Exclusion | Download |

| SSDI Self-Employment | Download | Plan to Achieve Self Support | Download |

| Subsidy or Special Conditions | Download | Section 1619(b): SSI and Medicaid Coverage | Download |

| Trial Work Period | Download | How to Report Wage Information to SSA | Download |

| How Your Earnings Affect Your Supplemental Security Income (SSI) | Download | What is SGA? | Download |

This project is funded in part by a Social Security cooperative agreement. Although Social Security reviewed this document for accuracy, it does not constitute an official Social Security communication. The above documents were published at U.S. taxpayer expense.